Project Laminar

Beating Schwab Intelligent Portfolios with ease.

Beating Schwab Intelligent Portfolios with ease.

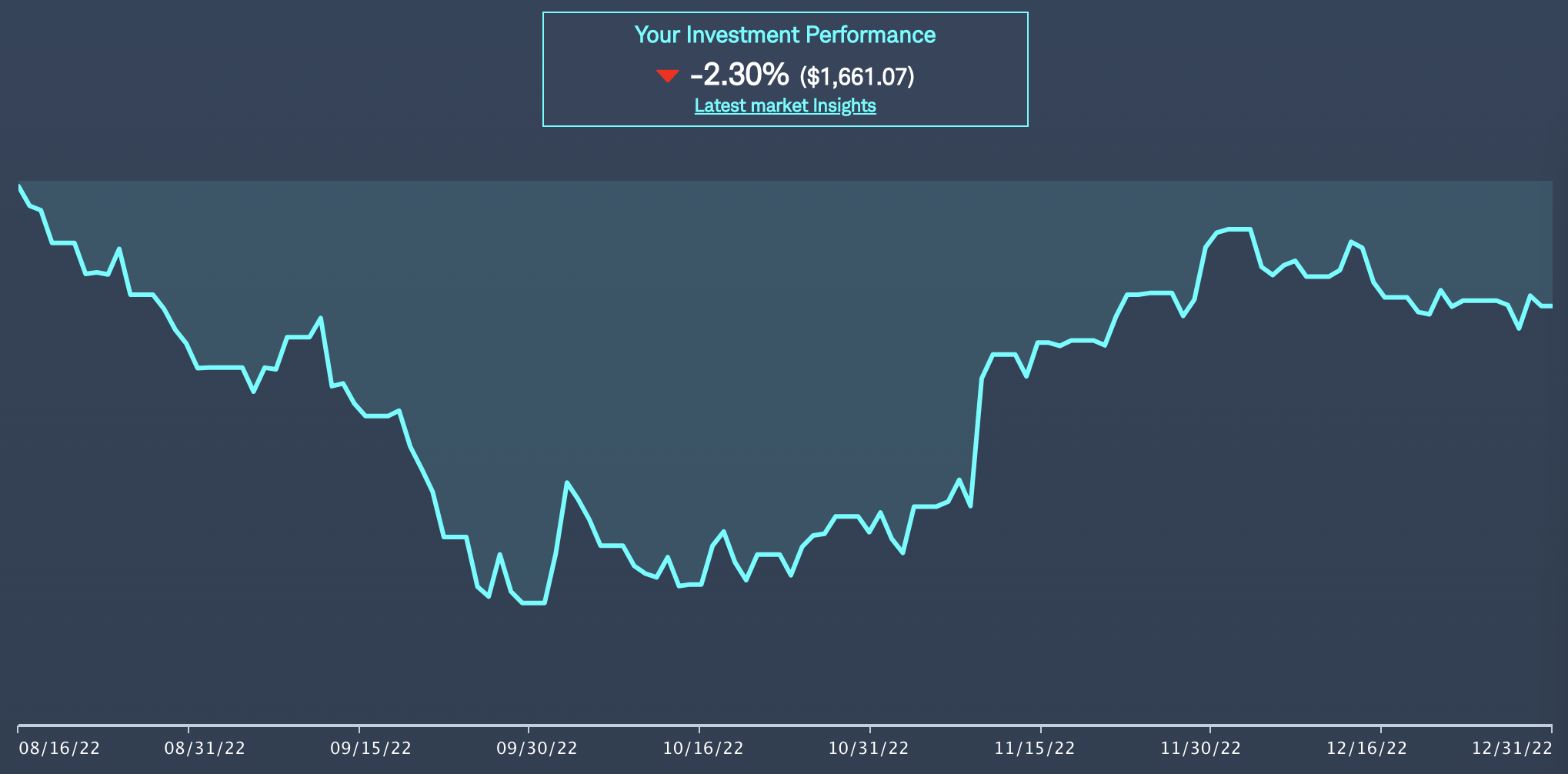

Schwab Intelligent Portfolios had a rough year in 2022. We did slightly better with the Laminar project, our implementation of a portfolio rebalancing bot which runs on the Alpaca platform and trades with real money.

For obvious reasons, the code will not be open source at any time soon. But this post shares how it works at a high level.

The entire project is composed of Luigi tasks, which allows us to build a data pipeline with complex dependencies that are automatically resolved. This helps us reason about the system and make sure there is no leakage of future data into our models.

Our data flow diagram looks something like this:

T = time

IngestNYT(T)

IngestOHLC(T)

(IngestNYT(0...T-1), IngestOHLC(0...T-1)) -> TrainModel(T)

IngestOHLC(T-1) -> EstimateCovariance(T)

(IngestNYT(T-1), IngestOHLC(T-1), TrainModel(T)) -> PredictReturns(T)

(EstimateCovariance(T), PredictReturns(T)) -> OptimizePortfolio(T)

OptimizePortfolio(T) -> RunLaminar(T)At the end of the day, we simply call RunLaminar(Now()) with the current timestamp and it backfills all the dependencies as necessary, using cached results whenever possible.

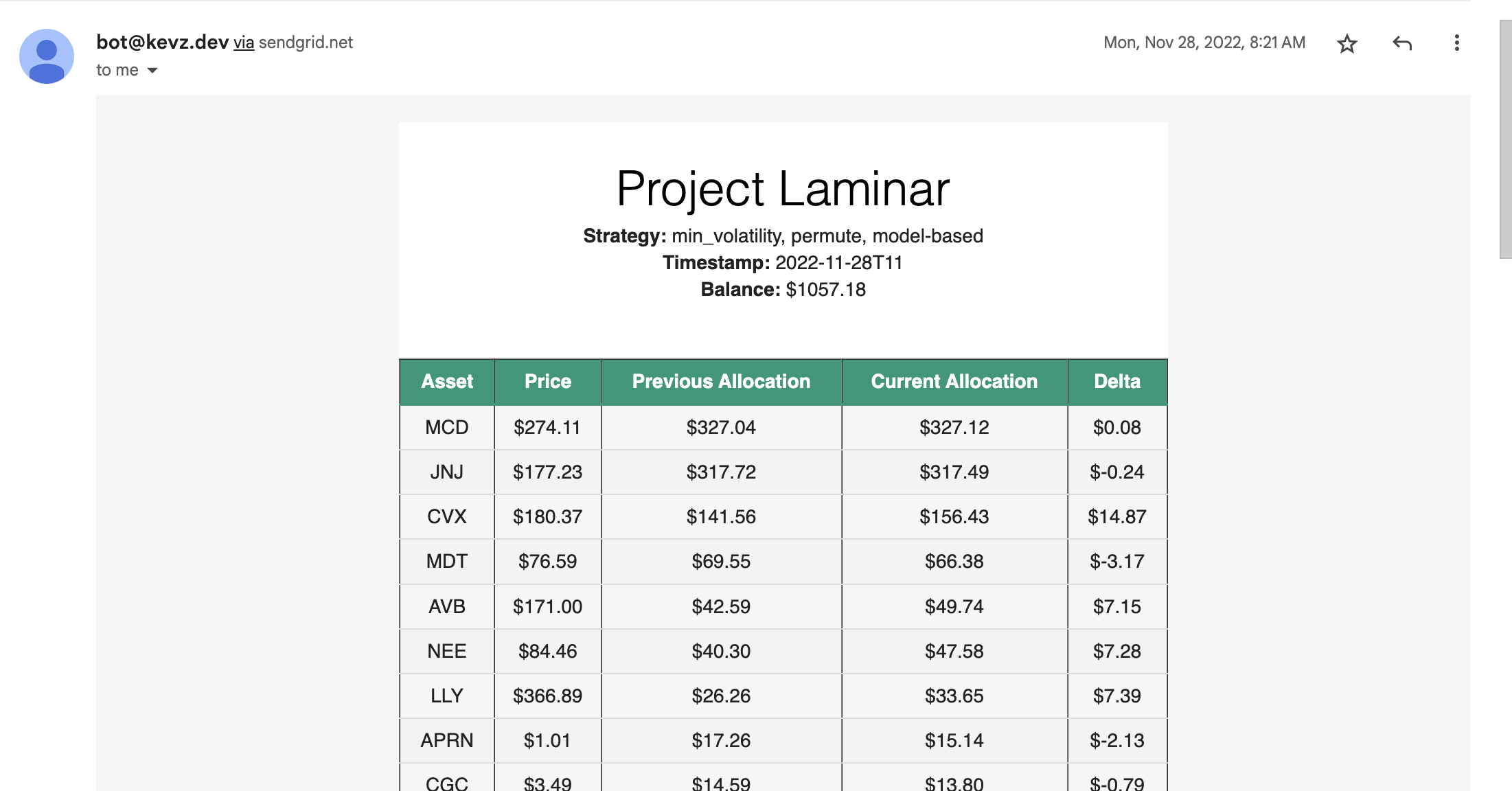

We build a Docker container containing all the dependencies and push it to AWS Batch, which then schedules a job every Monday, Wednesday, and Friday to rebalance our portfolio. After every rebalancing, the system sends us an automated email with the current portfolio so we can do a quick sanity check.

This AWS job has been running on this schedule for over 4 months now and only costs tens of cents a month, so we plan to keep it running for the foreseeable future.

This project was powered by: